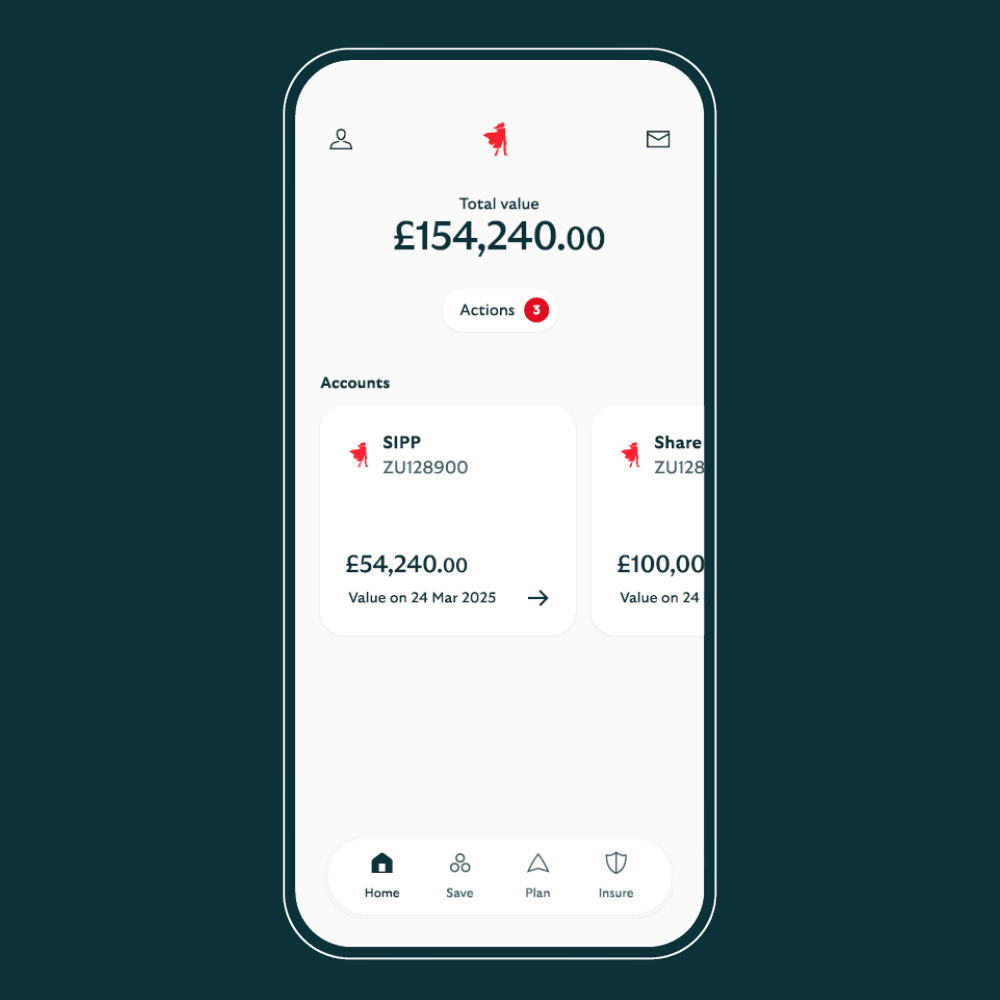

Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

See whether our Ready-Made Pension or Self-Invested Personal Pension (SIPP) is right for your retirement goals

Rather leave decisions about how to invest your pension savings to the experts? A Ready-Made Pension could help you meet your retirement goals, without the hassle.

Savvy trader, or keen to learn about investing and ready to do your own research? A Self-Invested Personal Pension (SIPP) could give you control over your pension savings and help you get the retirement you want.

Both of our pensions:

|

Features |

Ready-Made Pension |

SIPP |

|---|---|---|

|

Features Who’s it suitable for? |

Ready-Made Pension People who want to leave investment decisions to the experts |

SIPP People who are comfortable making decisions about their investments themselves |

|

Features Investing |

Ready-Made Pension Our experts invest your pension in a retirement portfolio based on the year you want to start taking your money. Our experts then slowly start to de-risk your investments the closer you get to this age |

SIPP You pick and trade your own investments and can change them at any time. |

|

Features Minimum payment |

Ready-Made Pension One of the following:

|

SIPP Pay in as little or as much as you want, starting from £1, including transfers. If you're a director of a limited company, you can also pay company contributions. |

|

Features Charges |

Ready-Made Pension Account admin charge:

Investment and transaction charges:

|

SIPP Account admin charge:

Investment and transaction charges:

Depending on your investments, there may be further charges. |

|

Features Taking money from your pension |

Ready-Made Pension Free |

SIPP Free |

|

Features Transferring eligible pensions in |

Ready-Made Pension Free |

SIPP Free |

|

Features Transferring out |

Ready-Made Pension Some or all of the value of your Ready-Made Pension can be transferred to another pension as a cash sum. |

SIPP Some or all of the value of your SIPP can be transferred to another pension as a cash sum. Or, if the receiving pension can accept them, you can transfer some or all of the investments held by your SIPP (know as in-specie transfers). |

|

Features Managing your pension |

Ready-Made Pension You’ll view, manage and top-up your pension in the app. |

SIPP You’ll view, manage and top-up your pension and place trades in the app. |

|

Features Taking your money |

Ready-Made Pension

|

SIPP

|

|

Features Get started |

Ready-Made Pension |

SIPP |

How your money is invested is a key difference between a Ready-Made Pension and a SIPP.

How it works:

How it works:

Our Ready-Made Pension and SIPP have different costs and charges, because of the differences in how your money is invested.

There’s no additional charge to take money from a Ready-Made Pension or a SIPP, or transfer in and out of your pension.

Account admin charge:

Investment and transaction charges:

For a detailed breakdown of all fees and charges, see the key features document (PDF, 165KB).

Account admin charge:

Investment and transaction charges:

Depending on your investments, there may be further charges.

For a detailed breakdown of all fees and charges, see the key features document (PDF, 194KB).

Always make sure there’s enough uninvested cash in your SIPP to cover any charges or payments.

You can pay into your Ready-Made Pension or your SIPP up to the age of 75 with:

You can also transfer into your pension from eligible existing pensions. There’s no age limit on this.

We accept payment by:

For Ready-Made Pensions and SIPPs, we can’t accept payments from a third party (such as your spouse, parent or grandparent) or from an employer.

With a SIPP, we can accept employer contributions if they are from a limited company where you are the business owner or one of the directors.

For Ready-Made Pensions, the minimum amount you must pay in is

With a SIPP, you can pay in as little or as much as you want, starting from £1, including transfers.

You can transfer pensions into a Ready-Made Pension and a SIPP, but there are a few things to know before you do.

We can accept a transfer in if:

We don’t charge for transfers, but your existing pension provider may do.

You are free to transfer your SIPP or Ready-Made Pension to another UK registered pension scheme, or Qualifying Recognised Overseas Pension Scheme (QROPS), at any time.

If you have a Ready-Made Pension, we’ll sell your investments into cash before transferring to the other provider.

If you have a SIPP, we can transfer investments or cash, if your new pension provider can accept them. If they can’t, or if you want to transfer as cash only, you’ll have to sell all the investments in your SIPP before you start the transfer process.

You can transfer investments into your SIPP without having to sell them first.

When you transfer investments:

This works in the same way for Ready-Made Pensions and SIPPs.

Every time you make personal contributions into your pension, you could get tax relief from the government.

You won’t receive tax relief on any transfers into your pension.

If you have a SIPP, and you’re paying into it as a limited company director or business owner, there’s no tax relief on these contributions as these have not been taxed.

If you have a Ready-Made Pension or a SIPP, you’ll manage it in our award-winning app

Here you can:

If you have a SIPP, you can also:

For any kind of personal pension, there’s a few things that are good to do and know.

The Scottish Widows Self-Invested Personal Pension and Ready-Made Pension are provided by Embark Investment Services Limited, a company incorporated in England and Wales (company number 09955930) with its registered office at 33 Old Broad Street, London EC2N 1HZ. Embark Investment Services Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register number 737356).

Dealing and stockbroking administration services for the Scottish Widows SIPP are provided by Halifax Share Dealing Limited (HSDL), which is a wholly owned subsidiary of Embark Group Limited and part of Lloyds Banking Group. HSDL is a company incorporated in England and Wales (company number 3195646) with its registered office at: Trinity Road, Halifax, West Yorkshire, HX1 2RG. HSDL is authorised and regulated by the Financial Conduct Authority (Financial Services Register number 183332). HSDL is a member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

Every time you pay in to your pension, you get tax relief from the government.

Lots of us have pensions from old jobs. Bringing them together could make life easier.

Small steps to take today that will make all the difference tomorrow.

Understand your pension and plan for your retirement.

Understand your pension and plan for your retirement.