Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Any tax treatment depends on your personal circumstances and may change in the future.

If you already have an account with Scottish Widows Share Dealing (formerly IWeb), log in to manage your investments.

Or manage your account in the app and start trading on the move today.

A Stocks and Shares ISA is a type of Individual Savings Account (ISA) which is tax-efficient to use. You pay your money into the ISA and choose where you want to invest it.

When you open a Stocks and Shares ISA with Scottish Widows Share Dealing, you automatically get a separate Share Dealing Account at no additional cost.

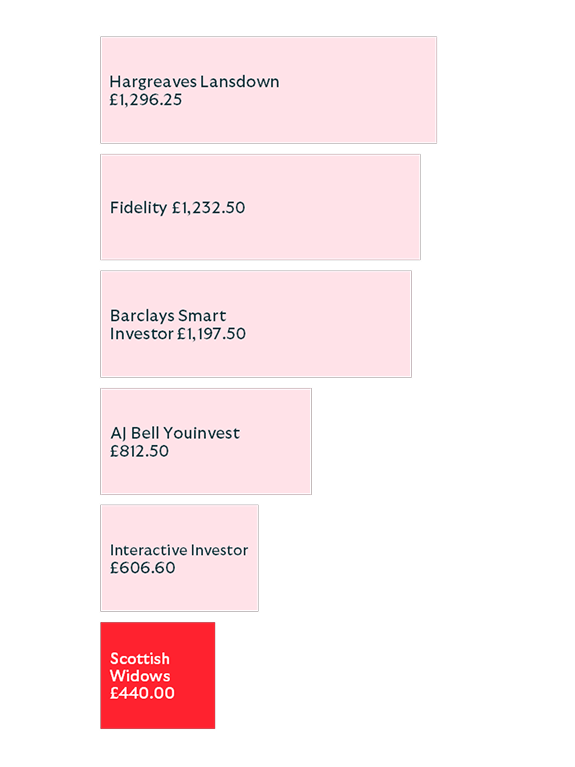

Over five years Stocks and Shares ISA customers could save up to £856.25 in platform charges.

This chart is based on a five-year projection of an average Scottish Widows Stocks and Shares ISA customer – see how we calculated this.

It excludes fund manager costs. These may vary depending on the share class available on each platform. You can find these in the fund’s Key Investor Information Document. In addition, you may have to pay government taxes or levies.

Data has been taken from competitor websites and was correct as of 10 February 2026. These costs could change in the future.

Scottish Widows £440.00

Interactive Investor £606.60

AJ Bell Youinvest £812.50

Barclays Smart Investor £1,197.50

Fidelity £1,232.50

Hargreaves Lansdown £1,296.25

Exchange Traded Funds (ETFs) are a simple, low-cost way to build an investment portfolio.

We've worked with iShares by BlackRock to bring you our ETF Quicklist – a shortlist of ETFs covering different countries and themes.

Access a wide range of stocks with just one investment.

With more than 2,500 funds available, you can build your own portfolio in no time.

Discover available shares and funds in our Funds and Shares Centre. And keep up to date with the latest FTSE data.

Get up-to-date market news, FTSE performance and relevant insights to help you choose the right investment.

Stay on top of what's happening and where, with our range of tools and market analysis.

Since 6 April 2024 you can subscribe to as many of any type of ISA including Stocks and Shares ISAs (except for Lifetime ISAs) as you like. Just remember to stay within the yearly ISA allowance to be free from UK taxes.

An ISA can be a great way to start investing in stocks and shares. You can invest £20,000 each tax year free from UK tax, with either our Ready-Made Investments or by choosing your own investments.

It’s worth starting with an ISA, and if you want to invest more than £20,000 each tax year, you can then open a Share Dealing Account which gives you the same access to a wide range of funds, investment trusts and ETFs, with no investment limit.

No, you don’t need to put all your money into an ISA. You might want a savings account for short-term needs or in case of an emergency. Then, you could invest money you don’t need right away in a Stocks and Shares ISA.

Yes, you are allowed to have a Cash ISA and a Stocks and Shares ISA. You can also have a Lifetime ISA and an Innovative Finance ISA. And you can have multiple ISAs of the same type.

However, the total amount you can pay in to all ISAs open in your name, to benefit from the tax-efficiency of an ISA, is a maximum of £20,000 each tax year.

Please note, you can only invest up to £4,000 into a Lifetime ISA each tax year.

You can invest in a Stocks and Shares ISA at any time – so long as you’re at least 18 years old. If you’re coming to the end of a tax year, you may want to invest and make the most of your remaining ISA allowance.

The Financial Services Compensation Scheme (FSCS) protects up to £85,000 of the eligible money you hold with us.

The Scottish Widows Share Dealing Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

Maxed out your ISA? Low cost investing without limits.

Low cost investing, managed for you by our experts.

Take control of your pension investments with our flexible personal pension.