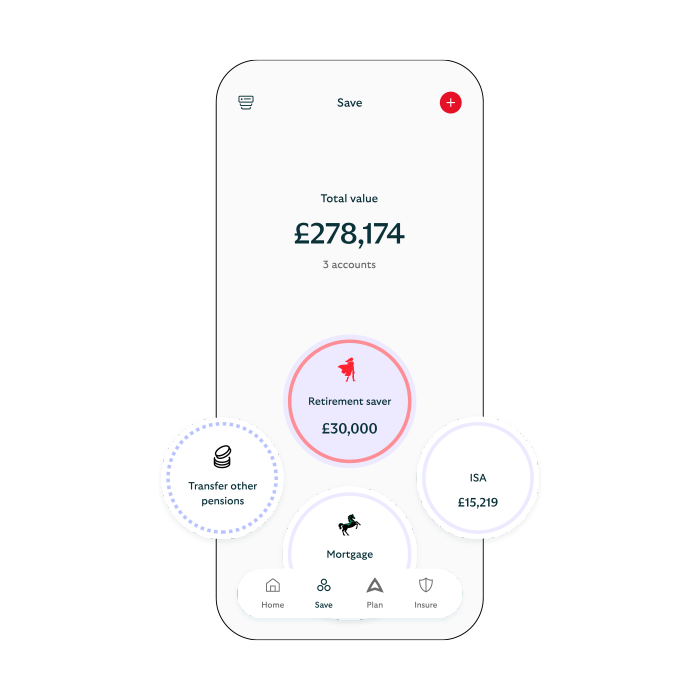

Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Where ever you are on the road to retirement, take some small steps today that will make all the difference tomorrow.

The earlier you can start saving for retirement, the better. The longer your money is invested in a pension, the better chance it has to grow. And the more you can put away, the sooner you could reach your retirement goals.

See what you could get at retirement with our retirement calculator.

Many of us have a few old pensions from previous jobs. Moving them into a single pot could make it easier to manage your finances and give you a clearer view of your savings. Some of your existing pensions’ benefits and features might be valuable. If you transfer to us, you’ll give these up, so it’s worth checking to see if it’s right for you.

Scottish Widows do not charge to transfer into our pensions, but your old pension providers may do. Check with them before you decide.

If you're self-employed, saving for the future can be harder than for people in permanent jobs. You don't get the benefit of a workplace pension and your earnings may go up and down. Starting a personal pension and paying into it regularly can help secure your financial future if you work for yourself.

You can increase the amount you pay into your pension at any time.

Had a pay rise, bonus, or inherited some money? Think about paying it into your pension. Paid off loans or debts? Put the extra cash towards your retirement income.

Paying more into your pension over time can make a big difference to your standard of living in retirement. You can do this either as small regular contributions or as a larger one-off payment.

When you pay in a percentage of your salary into a pension, most employers will either match this or pay in more than you do.

So if your current employer has provided you with a workplace pension, make the most of the opportunity to save for the future before diverting money to a personal plan.

In the UK, you get tax relief on your pension contributions, up to a limit. When you pay into a workplace pension, your employer normally applies tax relief for you. If you have a personal pension or self-invested personal pension, most providers will add tax relief for you up to the basic rate of tax. This is currently 20%. If you're a higher or additional rate taxpayer, you can claim any additional tax relief through self-assessment.

Before you reach retirement, it’s important to think about how you want to take money from your pension.

There are usually several options for you to choose from. It’s worth knowing what each one means for you when it comes to accessing your pension. Explore your pension options.

Keeping track of pensions as you move between jobs can be tricky. But those old pensions could give you extra income in retirement. It’s worth hunting them down if you can.

Contact your old pension providers or employers to find lost pensions. Contact us to find an old Scottish Widows pension. You can also use the government’s pension tracing service.

Depending on when you were born, you should start to get your State Pension between ages 66 and 68. Check when you'll get your State Pension using the government’s check your State Pension age service.

You can also see if you've got any gaps in your National Insurance history, or top up as required to ensure you receive your full State Pension.

You can normally take money from your pension from the age of 55 (rising to 57 by 2028). But you don’t have to.

You can keep your pension untouched and invested as long as you like, giving your long-term savings the best chance to grow.

There’s no maximum age to retire, although you can't normally contribute into a pension over the age of 75.

See what impact delaying retirement age could have on saving with our retirement calculator.

It’s worth thinking about where your pension will go when you’re gone.

You can leave your money to loved ones, such as a partner, friends or children. You might even nominate your favourite charities as beneficiaries.

You can update these details at any time if you have a big life event, such as a marriage, divorce, birth or death.

Simply log in to our app or go online.

If you haven’t already done so, download our app or register for our digital services.

All pension providers, including Scottish Widows, charge fees. How much you pay depends on your providers and type of pension. For example, your workplace pension may charge less than a personal pension.

Charges may include:

It’s worth checking what impact any charges have on the overall value of your pensions. You'll find the details in your annual statements or illustrations your providers have sent you.

It’s important to be aware of common pension scams and understand how we would contact you if we needed to.

Never give your pension details out over the phone or click any links in suspicious emails, texts or WhatsApp messages.

Find out how pension scams work, how to avoid them and what to do if you think you've been scammed.

Self-employed, or looking for an extra way to save? Our simple, personal pension can make it easier to start saving for your future.

Lots of us have pensions from old jobs. Bringing them together could make life easier.

Having a pension is a great way to put money aside for later life. Saving what you can afford each month could help you enjoy your retirement.

One of the main benefits of a pension is the tax relief that you receive. But it is worth noting that there are annual limits on how much tax relief you get on pension payments.

Your pension investments also generally grow free of UK tax (for example, no Capital Gains Tax to pay on investment growth). This means your pension could be a tax-efficient way to save for your future.

Speak to your employer. Auto-enrolment means most employed people in the UK should be automatically added into a workplace pension. If you work for yourself, or don’t qualify for your employer’s workplace pension, you can easily set up your own personal pension, such as our Ready-Made Pension.

While you may qualify for the State Pension, this may not be enough for you to enjoy your retirement. And without your own personal pension, you may have to be more cautious in retirement.

When saving for the future, it’s a good idea to find the right balance between contributing to short and long-term savings. A savings account is more accessible in the short term, but doesn’t get a boost from tax relief. However, your pension pot can benefit from UK tax-free savings and employer contributions and is only accessible from the age of 55 (rising to 57 in 2028).

Pensions are a type of long-term investment. It’s important to remember that, like any investment scheme, the value of your pension can go down as well as up over time. The earlier you start saving, the greater the chance for your investments to grow.

Like most providers, we’ll send you a statement every year. This includes an illustration showing the income you might get at retirement.

You can also use our retirement calculator at any time to help you see what you may get at retirement. You can also see how increased contributions or taking a smaller tax-free lump sum affect your annual pension income.

There’s no ‘right’ amount to save in your pension, but it helps to pay in as much as you comfortably can. Use our pension calculator to help you see what you may get at retirement.

Paying into a pension earlier can bring benefits later down the line as it gives your investment more time to grow.

However, any age is a good age to start a pension – especially if your employer is offering to make contributions or match your own.

Having a personal pension can be even more important if you’re self-employed, as you’re the only one contributing to your retirement.

You won’t receive employer contributions, but you will benefit from a tax-relief boost. So, it’s worth calculating what you’ll need once you decide to retire. This includes how much you’ll have to contribute each month to reach your retirement goal.

No, you’re not required to have a personal pension. However, it can be a tax-efficient way of planning for your financial future.

You receive government tax relief when you pay into your pension. For example, if you pay in £80, HMRC will add an extra £20.

When you decide to withdraw from your pension, the first 25% is generally tax-free. The rest is taxed as income. This depends on the retirement benefits you take.

Don’t forget that tax treatment depends on your individual circumstances, and both your circumstances and tax rules may change in the future.

You must be at least 65 years of age to currently be eligible for the State Pension.

This will rise to 66 from April 2026, 67 by March 2028, before eventually increasing to 68 years old.

To receive any State Pension, you'll need at least 10 qualifying years of National Insurance contributions. And at least 35 years to receive the full State Pension.

The current full State Pension is £230.25 a week for 2025/26. However, what you receive depends on how much National Insurance you’ve paid while working.

To receive the full amount, you’ll need more than 35 years of qualifying National Insurance contributions.

Bring your long-term finances to life with the Scottish Widows app.

See your pensions, investments and insurance from us and other providers, all in one place.

All you need to get started is your National Insurance number.

Understand your pension and plan for your retirement.

Understand your pension and plan for your retirement.