Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

A smarter way to invest.

We’re waiving our £3 monthly account fee until 01 July 2026.

It’s a smarter way to invest.

Our Ready-Made Investments account gives you a complete portfolio of funds, built and managed by our experts, making it simple to invest with the potential to grow your money.

Don't miss out! There's still time to use your ISA allowance to save more for the future.

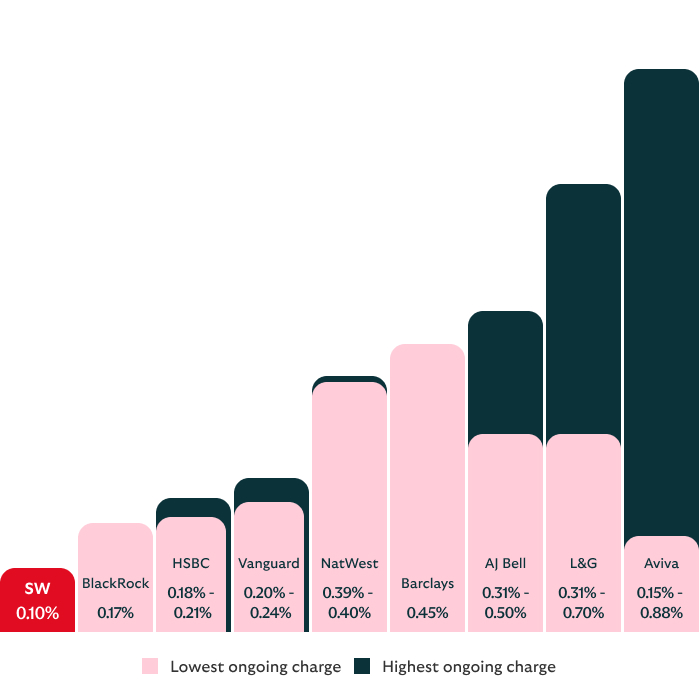

Our ongoing fund charges are some of the lowest on the market, so more of your money is invested.

This graph shows ongoing charges only - from a selection of comparable competitor’s fund offerings. Other account fees and charges also apply.

We sourced the data from competitor websites, accurate as of 10 February 2026.

|

Provider |

Charges |

|---|---|

|

Provider Scottish Widows - Ready-Made Investments |

Charges 0.10% |

|

Provider BlackRock - MyMap |

Charges 0.17% |

|

Provider HSBC - Global Strategy Portfolios |

Charges 0.18% - 0.21% |

|

Provider Vanguard - Life Strategy |

Charges 0.20% - 0.24% |

|

Provider NatWest - Invest |

Charges 0.39% - 0.40% |

|

Provider Barclays - Ready-Made Investments |

Charges 0.45% |

|

Provider AJ Bell – Growth, Responsible Growth and Income Funds |

Charges 0.31% - 0.50% |

|

Provider L&G – Multi-Index Funds |

Charges 0.31% - 0.70% |

|

Provider Aviva – Multi-Asset Funds |

Charges 0.15% - 0.88% |

Ongoing charge and transaction costs are calculated on an ongoing basis and built into the value of the fund This varies with market conditions and is already reflected in the fund’s performance.

For more information about the three funds, you can read our fund range and investments guide (PDF, 208KB). It contains details of how the funds are managed, their objectives and risks, and a detailed breakdown of the charges.

Investments are sold at a minimum value of £10. All remaining sales proceeds, after the £3 fee has been paid, will be held as cash in your account and will be used to contribute to future monthly fees.

Aim to build up your investments

At very low balances, fees can outweigh any growth – and could even reduce your account balance to zero.

Investing for longer increases the likelihood of positive returns. Over a period of five years or more, investments usually give you a higher return compared to cash savings. But investments can go down as well as up in value, so you could get back less than you put in.

This data shows how these funds have performed over the past 5 years. This can help you understand how these funds have changed over the longer term.

Remember, past performance isn’t a reliable indicator of future results.

This graph shows the percentage change in each fund since launch.

The last available price shown in the graph is usually the price from the previous trading day. This price may differ on the date that you choose to invest.

The data includes the ongoing charge and all transaction costs within the funds. It doesn’t include the £3 monthly account fee.

|

Date |

Cautious |

Balanced |

Adventurous |

|---|---|---|---|

|

Date 30th Dec 2024 to 30th Dec 2025 |

Cautious 8.3% |

Balanced 11.6% |

Adventurous 16.2% |

|

Date 30th Dec 2023 to 30th Dec 2024 |

Cautious 5.9% |

Balanced 9.4% |

Adventurous 12.6% |

|

Date 30th Dec 2022 to 30th Dec 2023 |

Cautious 8.6% |

Balanced 9.9% |

Adventurous 11.0% |

|

Date 30th Dec 2021 to 30th Dec 2022 |

Cautious -12.3% |

Balanced -8.9% |

Adventurous -7.0% |

|

Date 30th Dec 2020 to 30th Dec 2021 |

Cautious 3.5% |

Balanced 8.2% |

Adventurous 12.5% |

This table shows how each fund has performed annually over the past 5 years.

What are the charges?

|

If your investment was worth |

Cautious |

Balanced |

Adventurous |

|---|---|---|---|

|

If your investment was worth £1,000 |

Cautious £38.30 |

Balanced £38.60 |

Adventurous £38.60 |

|

If your investment was worth £5,000 |

Cautious £47.50 |

Balanced £49.00 |

Adventurous £49.00 |

|

If your investment was worth £10,000 |

Cautious £59.00 |

Balanced £62.00 |

Adventurous £62.00 |

|

If your investment was worth £20,000 |

Cautious £82.00 |

Balanced £88.00 |

Adventurous £88.00 |

New to investing or need a refresher? Our quick guides explain the basics before you apply.

Investing is different from putting your cash in a savings account to earn interest. You’re essentially buying investments, for example, shares in a company, that you think you’ll be able to sell for a higher price later.

There are risks with any type of investment. Your money could lose value and you may not get back what you put in.

A fund is a package of investments. Your money is invested with other people's money in one fund.

Our funds are managed by a fund manager. They’re responsible for the mix of assets in the fund, and for giving you the best possible returns.

When you invest in a fund, your money and risk are spread in many different places. This is known as ‘diversification.’

Let’s say that some assets in a fund aren’t doing well. If the other assets are doing well, this could help to reduce any potential losses.

With ready made Investments you can invest in funds with a Cautious, Balanced or Adventurous investment style. See how our funds have performed in the past.

Whilst all investments carry some risk, this varies. Lower risk investments tend to be more stable and experience less volatility (ups and downs) but this comes with more limited opportunity for growth. Higher risk investments can provide the potential for higher returns but they may also experience more significant ups and downs.

It's important to remember fluctuations are a normal part of investing. Deciding on how much risk you are willing to take is a personal choice and can depend on a few things, such as:

If you’d like to have money set aside, either for specific goals or for emergencies, a savings account could be a better option. You’ll usually earn a small amount of interest and you’ll be able to access your money when you want.

If you invest your money, you should leave it for between five to 10 years to give it the best chance to grow. You may see the value of your investment go up and down, and you may not get back what you put in. But there’s often greater potential for higher growth over the longer term.

Learn more about the difference between saving and investing.

We won’t charge the account fee, (£3 per month), between 19 May 2025 and 30 June 2026.

All other charges will still apply.

The account fee will be charged again from 01 July 2026. From this date, all monthly fees will be charged as usual.

Separate terms and conditions apply to our Ready-Made Investment ISA or Ready-Made General Investment Account in relation to the service we provide.

We may amend or withdraw this offer at any time.

The promoters of the offer are Halifax Share Dealing Limited and Embark Investments Services Limited, who provide Scottish Widows Ready-Made Investments. The promoters are contactable at 12 Wellington Place, Leeds, LS1 4AP.

The Financial Services Compensation Scheme (FSCS) protects up to £85,000 of the eligible money you hold with us.

Ready-Made Investments is provided by Embark Investment Services Limited, a company incorporated in England and Wales (company number 09955930) with its registered office at 33 Old Broad Street, London, EC2N 1HZ. Embark Investment Services Limited is authorised and regulated by the Financial Conduct Authority (Financial Services Register number 737356).