Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

(formerly Black Horse Income Protection Plan).

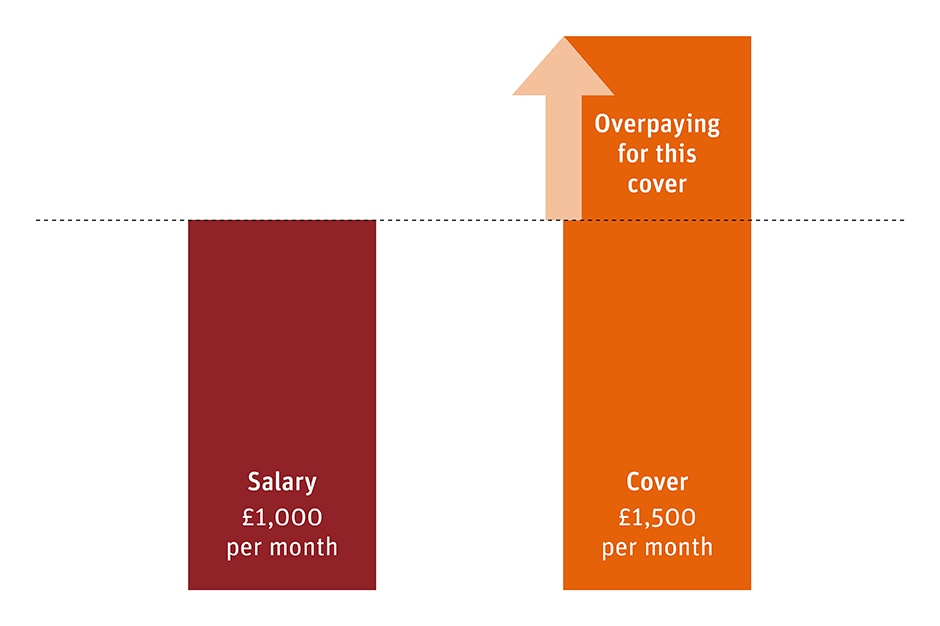

If you’re paying for a level of cover which is more than your monthly salary, we’ll pay you a percentage of your salary up to a maximum monetary limit. For example, if you are paying for cover of £1,500 per month, but you have a monthly salary of £1,000 at the time of claim, we’d only pay you a percentage of your monthly salary. In this example, you could have saved money by paying for less cover.

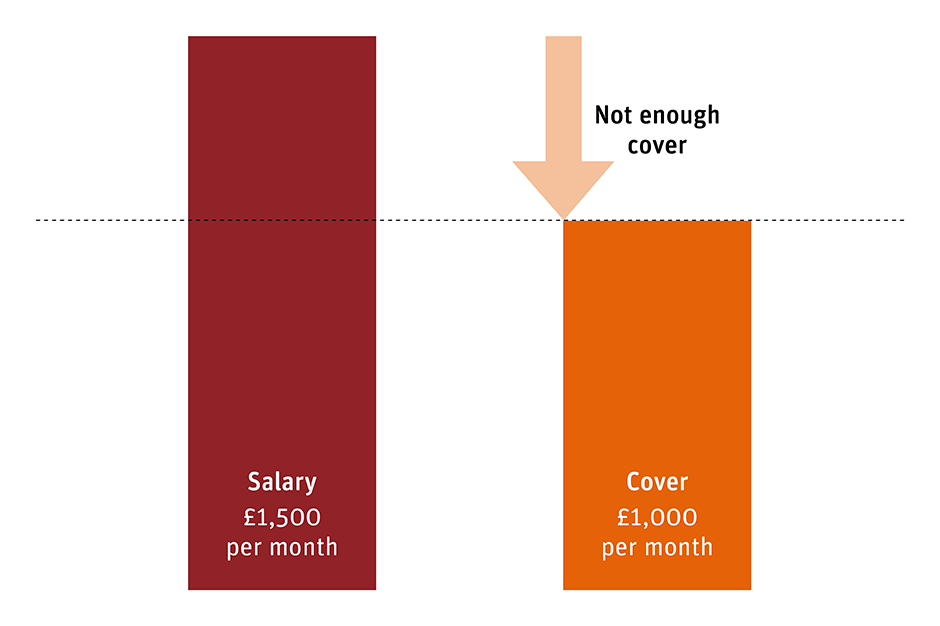

If the level of cover you’ve chosen is less than your monthly salary, you’ll only receive the amount of cover you’re paying for. For example, if you’re paying for cover of £1,000 per month, but your monthly salary is £1,500 at the time of claim, we’d only pay you a percentage of £1,000. In this example, you may not have enough cover and it’s important to review your level of cover.