Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Buying small shares (units) of an investment fund. This means that your money is invested in listed companies and other assets, which can rise and fall in value.

Paying for your life cover.

Charges for managing your plan.

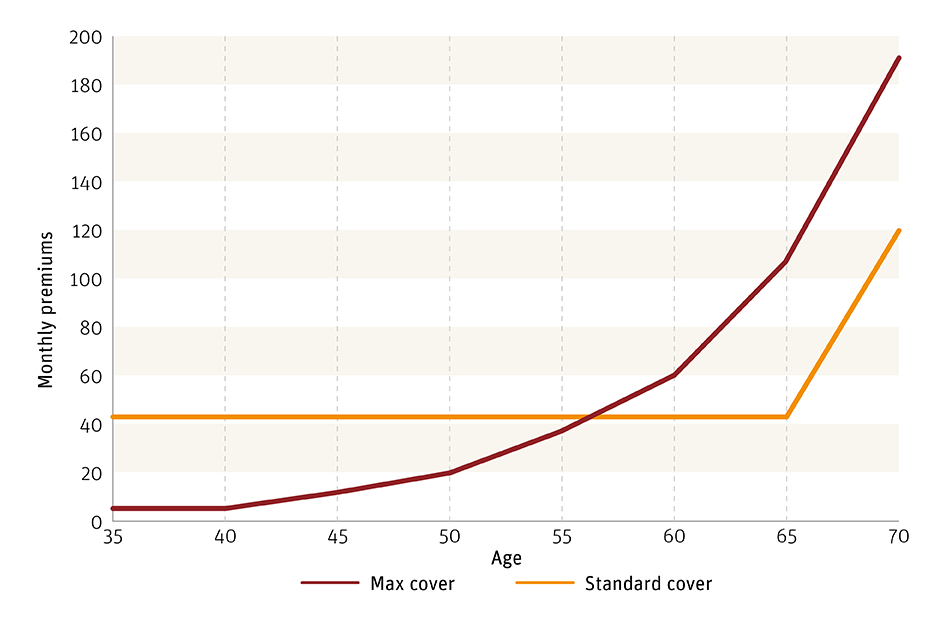

This is an example showing a sum assured of £100,000. For illustrative purposes only.