Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

We’re constantly reviewing what our competitors charge - so we can keep our own fees as low as possible. Why? Because we believe investing should be accessible, not expensive.

This page shows exactly how we stack up against the biggest names in the industry. And the numbers speak for themselves.

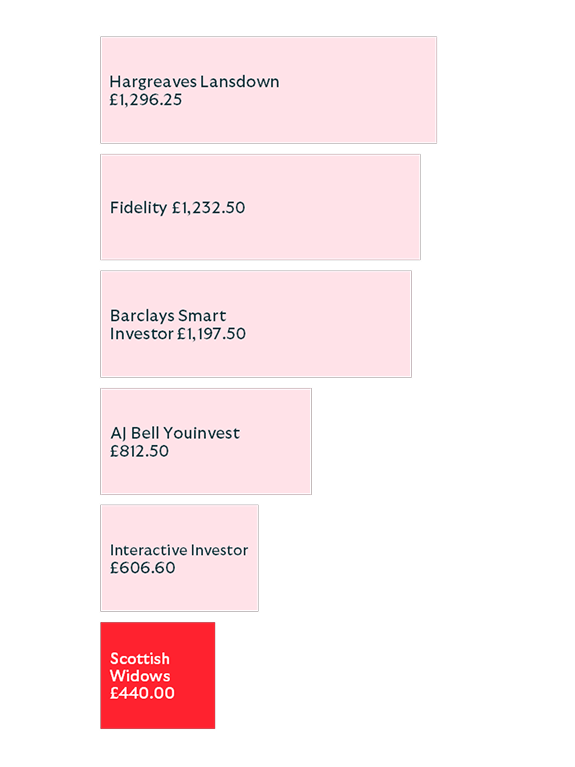

Investments are for the medium to long term, with a minimum of five years recommended. These graph and tables show how an average Scottish Widows Share Dealing Stocks and Shares ISA customer could save between £166.60 and £856.25 in fees over five years.

Over five years a Scottish Widows Share Dealing Stocks and Shares ISA customer could save up to £856.25 in platform charges.

This data has been taken from competitor websites and is correct as of 10 February 2026. These charges could change in the future.

Scottish Widows £440.00

Interactive Investor £606.60

AJ Bell Youinvest £812.50

Barclays Smart Investor £1,197.50

Fidelity £1,232.50

Hargreaves Lansdown £1,296.25

With so many pricing models out there, it’s tough to know what you’re really paying. That’s why we’ve laid it out clearly. Our simple graphic shows what our average customer could pay over five years, compared to five major competitors.

Because investing isn’t about quick wins - it’s about long-term growth. Five years is the minimum recommended timeframe to ride out market ups and downs and give your money the best chance to grow.

We’ve chosen the five biggest stockbrokers in the UK - because they’re the ones most investors consider. Like us, they offer broad investment access without charging a subscription fee.

No problem. Everyone’s investment journey is different. Use our full charges list to see exactly what you’d pay based on your own trading habits.

We’ve crunched the numbers to give you a realistic picture. As of 10 February 2026 we found the following statements to be true of our average Scottish Widows Share Dealing Stocks and Shares ISA customer. Figures are rounded to nearest significant number.

This table show what the average Scottish Widows Share Dealing Stocks and Shares ISA customer would pay in fees over five years.

|

Average amount for a Scottish Widows customer |

Calculation |

Total cost |

|---|---|---|

|

Average amount for a Scottish Widows customer 4 UK trades |

Calculation £5 for each trade |

Total cost £20.00 |

|

Average amount for a Scottish Widows customer 1 fund trade |

Calculation £5 for each trade |

Total cost £5.00 |

|

Average amount for a Scottish Widows customer 1 US trade of £4,200 |

Calculation 1.5% FX charge |

Total cost £63.00 |

This table shows breakdown of charges an average Scottish Widows Share Dealing Stocks and Shares ISA customer would pay with five of our competitors:

|

Customer activity |

Hargreaves Lansdown |

Fidelity |

AJ Bell Youinvest |

Barclays Smart Investor |

Interactive Investor |

Scottish Widows |

|---|---|---|---|---|---|---|

|

Customer activity £42,000 held in shares |

Hargreaves Lansdown £45.00 |

Fidelity £90.00 |

AJ Bell Youinvest £42.00 |

Barclays Smart Investor £105.00 |

Interactive Investor No charge |

Scottish Widows No charge |

|

Customer activity £25,000 held in funds |

Hargreaves Lansdown £112.50 |

Fidelity £87.50 |

AJ Bell Youinvest £62.50 |

Barclays Smart Investor £62.50 |

Interactive Investor No charge |

Scottish Widows No charge |

|

Customer activity 4 UK trades |

Hargreaves Lansdown £47.80 |

Fidelity £30.00 |

AJ Bell Youinvest £20.00 |

Barclays Smart Investor £24.00 |

Interactive Investor £15.96 |

Scottish Widows £20.00 |

|

Customer activity 1 fund trade |

Hargreaves Lansdown £0.00 |

Fidelity £0.00 |

AJ Bell Youinvest £1.50 |

Barclays Smart Investor £0.00 |

Interactive Investor £3.99 |

Scottish Widows £5.00 |

|

Customer activity 1 US trade of £4,200 value |

Hargreaves Lansdown £53.95 |

Fidelity £39.00 |

AJ Bell Youinvest £36.50 |

Barclays Smart Investor £48.00 |

Interactive Investor £41.49 |

Scottish Widows £63.00 |

|

Customer activity Administration charge |

Hargreaves Lansdown No charge |

Fidelity No charge |

AJ Bell Youinvest No charge |

Barclays Smart Investor No charge |

Interactive Investor £59.88 |

Scottish Widows No charge |

|

Customer activity Year 1 cost |

Hargreaves Lansdown £259.25 |

Fidelity £246.50 |

AJ Bell Youinvest £162.50 |

Barclays Smart Investor £239.50 |

Interactive Investor £121.32 |

Scottish Widows £88.00 |

|

Customer activity 5-year cost |

Hargreaves Lansdown £1,296.25 |

Fidelity £1,232.50 |

AJ Bell Youinvest £812.50 |

Barclays Smart Investor £1,197.50 |

Interactive Investor £606.60 |

Scottish Widows £440.00 |

|

Customer activity 5-year cost difference |

Hargreaves Lansdown £856.25 |

Fidelity £792.50 |

AJ Bell Youinvest £372.50 |

Barclays Smart Investor £757.50 |

Interactive Investor £166.60 |

Scottish Widows £0.00 |

Data is from competitor websites and is correct as at 10 February 2026. These could potentially change in the future.

Trading commission

Charges for each trade placed. Scottish Widows Share Dealing charges £5 for UK and Fund trades and no commission for International trades.

Foreign exchange charges

When you buy or sell an international stock, the share price is converted into GBP. Most providers adjust the exchange rate by a percentage and keep that as a fee. Scottish Widows Share Dealing charges 1.5% either side of the available exchange rate.

Percentage-based administration charges

Charges incurred based upon a percentage a what a customer holds in their account (e.g. cash or assets such as shares or funds). Scottish Widows Share Dealing does not charge for this.

Ongoing account charges

Account administration charges usually paid monthly or annually to your provider. Scottish Widows Share Dealing does not have any ongoing account charges.

Stamp Duty

When you buy a UK stock, you’ll pay a form of tax called stamp duty to the Government. Stamp duty is 0.5% of the value of the investments you buy (1% on Irish stocks). You won’t pay any stamp duty on AIM stocks or Exchange Traded Funds.

Fund Manager charges

Fund Managers will charge various fees such as an ongoing charge or transaction fees, and details of these are in the key investor information document for each fund.

PTM Levy

Any trade over £10,000 will incur a levy of £1.50. This amount is paid to the Panel on Takeovers and Mergers (PTM).