Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

Pension scams are on the increase and the tactics used are becoming more sophisticated.

Normally you can access your pension at the age of 55, this is increasing to age 57 in 2028, but in cases such as terminal illness it can be possible to access it sooner.

An increasing number of dishonest companies are targeting savers, claiming that they can help them take their pension early. They’ll normally ask you to transfer your pension to an unregulated scheme promising you high returns. But the reality is often that your pension value is diminished by bad investment decisions in complex and unregulated products and by high commission payments.

Scammers promise to help you ‘liberate’ your pension without penalty, offering cash incentives or personal loans if you do this. If you do this you’ll end up paying a tax penalty – there’s no way to avoid paying without breaking the law.

As a pension provider we have to notify HM Revenue and Customs (HMRC) when you take benefits from your pension before the age of 55 so they can recover the necessary payments. The cost of taking your pension early can be:

A tax bill of between 55% and 70%

A charge of up to 20% of the value of your pension

Our short film runs through how to spot a pension scam.

If you suspect that you have been the victim of a scam you should contact us or your existing Pension Provider immediately.

You can also find more helpful information at:

If you receive an unexpected call, text or email from an individual or firm about your pension, this may not be legitimate. Scammers are also targeting victims through social media platforms, using direct messaging or the chat functionality.

You should also be aware of anyone who contacts you unexpectedly to discuss your pension planning or offer a pension review and claims to work for a Government body such as the Money and Pensions Service (MaPs) or Pension Wise from MoneyHelper. It could be part of a scam.

If you think that you’ve been the victim of a scam you should contact us or your existing Pension Provider immediately. The following steps can help you check that a pension opportunity is genuine.

Scammers can be financially knowledgeable with authentic-looking websites, testimonials and marketing materials that are hard to distinguish from the real thing. Scammers try to persuade pension savers to transfer their entire pension savings, or take money out of it, by making attractive promises that they have no intention of keeping.

Scammers may use the terms ‘pension liberation’, ‘free pension review’, ‘limited time offer’, ‘one-off investments’ or discuss ‘loopholes’ that allow you to access funds before you’re 55. They can also promise ‘too good to be true’ returns and opportunities. These types of opportunities are unlikely to be genuine.

If you’ve been promised a high guaranteed return on your pension investment, then we recommend that you receive advice or guidance. The following steps can help you check that a pension opportunity is genuine.

Scammers will sometimes promise savers early access to their pension pot through loans, loopholes or cashback deals.

An individual or firm offering such a scheme, is likely to be trying to scam you.

Savers could lose all their money and face a high tax bill from HM Revenue and Customs (HMRC) if they withdraw their pension savings before the age of 55 (in 2028, the Government is increasing the age from which pension benefits can normally be taken to age 57).

If you've been offered an early release of cash from your pension pot, then you should check this isn't a scam. The following steps can help you check that a pension opportunity is genuine.

Scammers often ask pension savers to invest in unusual high-risk investments, which tend to be overseas, unregulated and with no consumer protections. The pension money is often invested in a range of investments like:

If there are several parties involved in your pension, they may all be taking a fee, which means the total amount deducted from your pension is significant. You might be persuaded to invest in assets that may be locked into a fixed investment period or are otherwise difficult to sell when you need access to your money. You need to check your pension savings regularly, otherwise it could be several years before you realise something is wrong.

Many scammers often persuade savers to transfer their money into pension schemes that the scammer controls. Scammers may also pretend to help you and ask you to download software or an app so they can gain access to your device. This could enable them to also access your bank account or make payments using your card.

If you’ve been asked to invest in an unusual asset, this may be a scam. The following steps can help you check that a pension opportunity is genuine.

You can usually only take money from your pension when you’re 55 or older, except in certain circumstances, like having a terminal illness.

The Financial Conduct Authority (FCA) has warned savers to beware of scammers as thousands withdraw pension savings to cover the cost of living crisis.

If you're required to take money out of your pension to invest in a particular asset you could be being scammed. You will not normally be required to withdraw pension monies to be able to invest them. Instead, your pension savings will be invested directly in the funds or assets you select.

If you do decide to withdraw funds from your pension to invest elsewhere, you should independently verify whether the new investment is legitimate.

If you’ve been asked to withdraw money from your pension, be aware that this may be a scam. Do not proceed with any transaction that you have doubts about.

Scammers use high pressure sales tactics such as time limited offers to get the best deal. They can also use couriers to send documents to you, who may even wait with you until they’re signed. Scammers might warn you that your current pension provider or former employer will try and stop you transferring out, suggesting that they just want to keep your money.

This isn’t the case. Your pension provider will have to do some thorough due diligence checks on the scheme you’re planning to transfer to. If they suspect a scam, they have a legal obligation to try to protect your funds.

You should take your time and never be rushed into making a decision. You need to fully understand what you are being asked to do before making such a significant decision. You should also obtain suitable advice and guidance. If you don’t have one, you can find a financial adviser at www.unbiased.co.uk Advisers normally charge for any advice they give. You can also contact Pension Wise from MoneyHelper on 0808 196 2316 for guidance.

Don’t be rushed or pressured into a decision. Before accessing your pension, we recommend you receive advice or guidance before making a final decision. If you’ve not already spoken to someone, there are options for you.

If you are aged 50 or over, you can arrange a free appointment with Pension Wise. Pension Wise from MoneyHelper is a free and impartial service, which helps you understand your options for using your retirement savings. Provided by MoneyHelper, a government organisation, it offers clear and simple guidance (not advice) online, over the phone or face to face. To find out more or make your own appointment directly with them, visit Pension Wise from MoneyHelper or call 0808 196 2316.

You can also contact your financial adviser if you would rather have advice. If you don’t have one, you can find a financial adviser at www.unbiased.co.uk Advisers normally charge for any advice they give.

Following a few simple steps can help you check that a pension opportunity is genuine. You should not rely on the person contacting you to provide answers to the questions you have; instead you should carry out the following research yourself:

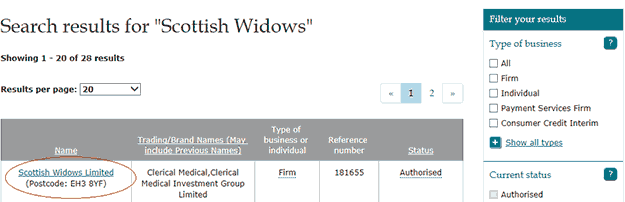

The FCA website is simple to navigate, this is how you would search for Scottish Widows, for example: