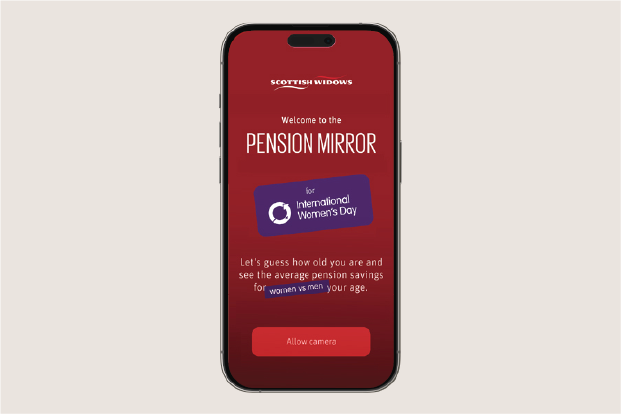

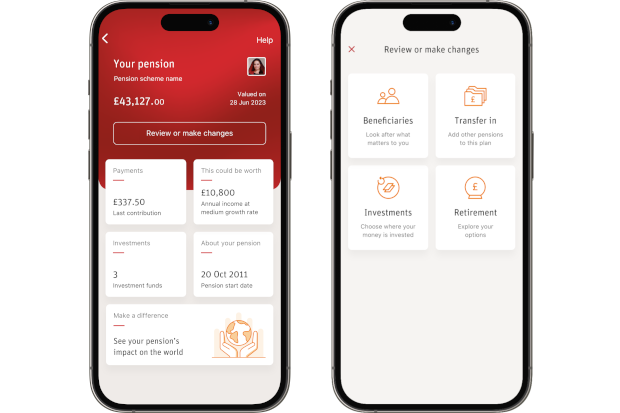

Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

International Women’s Day 2024

On average, the gender pension gap jumps from £100 to £100,000 over a woman’s working life. This International Women's Day find out what’s driving such a huge difference in women and men’s pensions, and what you can do between the ages of 22 and 65 to help get pensions equality.

Find out what the pension gap is for your age, and how you can beat it.

The Pension Mirror will guess your age and how the average woman and man’s pension pots compare.

Let us guess your age.

Our Beat the Gap tool makes it personal, showing you when your own pension gap is most likely to occur and the top three ways you can help beat it.

See how you can Beat the Gap

The pension system is better suited to a more typically male pattern of working and savings. Things like pay inequalities, part time working and time off to manage childcare continue to make it harder for women to save as much across their working life and are the biggest drivers of the gender pension gap.

Although pay inequalities continue to exist, younger generations, especially women are saving for retirement earlier, 62% of women currently aged 22–29 said they started to save for retirement by the age of 25. This is good news but women still tend to earn less than men at all points in their working lives and as a result typically save less into their pension over this time.

After women have children the gap between their pension and a typical man’s starts to widen. For men, having children doesn’t normally impact their pension. This is because women tend to take on the lion’s share of childcare. Research tells us that 37% of mothers have left a job to cover childcare compared with 18% of fathers.

Employment breaks and part time working are big drivers of the gender pension gap. Earning less and potentially missing out on employer contributions into their pension, makes it harder for women to save enough for an equal retirement. 47% of mothers have gone part time to look after their children compared to 15% of fathers and men’s salaries are more likely to grow consistently over their working life.

We can help you manage your savings and plan for the retirement you want with our online services and mobile app.

Your secure online account gives you access to your pension savings.

To help close the gap we’re working with organisations across our industry, the education sector and the Government. We’re committed to highlighting the issue, providing support and guidance as well as campaigning for pension reforms that could make it easier for women to save for retirement.

Our 5th International Women’s Day partnership helped shine a light on the gender pension gap. Our 2024 campaign brought our own data and expertise to life through our new Beat The Gap tool and social media.

We’re celebrating 20 years of industry leading research into Women & Retirement, the findings we use to lead the discussion and make recommendations to lobby for change. We champion making better pensions information and education material available for our scheme members and for all women.

We use platforms like International Women’s Day to raise awareness. We are proud to have been recognised at the 2024 Pension Age awards, winning the Diversity Award for our Women and Retirement activity.