Your pension in your pocket

Our app makes it easy to keep an eye on your pension and plan for the future.

The ability to take money when you need it is known as flexible access. There are two flexible access options available – Flexi-access Drawdown and Partial Pension Encashment.

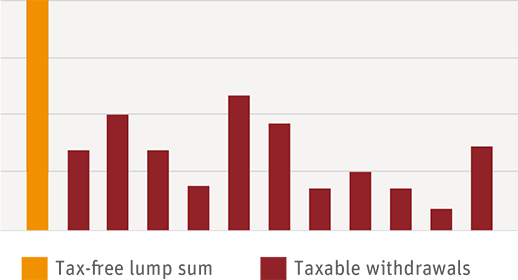

The above graph shows how with PPE you can spread your tax-free lump sum allowance across the withdrawals you make.

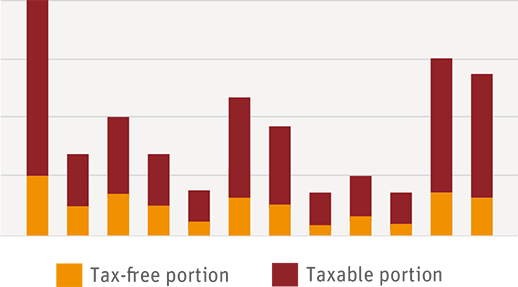

The above graph shows how with flexi-access drawdown your tax-free lump sum can be taken at the outset with any future withdrawals being taxable.

If you die before you reach age 75, what’s left will normally be paid tax free to your beneficiaries. They can then choose to take it as an annuity, a lump sum or through beneficiary’s drawdown.

If you die after you reach age 75 your beneficiaries have the same options but these will be subject to tax.

Death benefits on pensions are changing from 6th April 2027, if you die after that date and have money left in your pension it may be subject to inheritance tax.

The Annual Allowance is the total that can normally be paid into any pensions you have, each tax year, before you have to pay a tax charge. The Annual Allowance for the current tax year is £60,000.

Once you access your pension flexibly, (apart from solely taking tax-free cash), a lower allowance called the Money Purchase Annual Allowance (MPAA) will apply. The MPAA for the current tax year is £10,000. This limit does not apply to any benefits you build up in "defined benefit" (often called "final salary") pensions. This may change in the future.

For flexi-access drawdown, the MPAA applies when you first take money from your drawdown plan.

For partial pension encashment it applies the first time you take money out.

Most people ‘shop around’ for car and home insurance. But many people don't know that you can do the same when comparing flexible access products. Shopping around could help you get more for your money.

In some cases you might need to move your pension to a different provider to get what you’re looking for. But comparing flexible access products yourself can be difficult. Visit the government backed MoneyHelper website to find out more.

Choosing how to take your money is a big decision. Pension Wise from MoneyHelper is a free and impartial service that helps you understand your options for using your pension. It’s a government organisation that offers clear guidance online or over the phone. To find out more or book an appointment visit moneyhelper.org.uk/pensionwise or call 0800 138 3944.

If you’re unsure or need more help to make sure you know which option is right for you, we recommend that you speak to your financial adviser. If you don’t have one, you can visit unbiased.co.uk to find one. Advisers will normally charge for their advice.

If you’re happy that you’ve considered all your options and understand what’s best for you, you’re ready to take the next steps towards your retirement.

You don't have to use just one option. You can combine these options in many different ways to meet your needs. Have a look at our table (PDF, 50KB) to help you compare the options.