How Scottish Widows is embedding forward-looking climate metrics into investment strategy

To help support good customer outcomes and build more resilient portfolios, we have evolved our responsible investment proposition as we strive to ensure that responsible investment is fitted as standard across our business.

This has seen us work with a range of sustainable investing leaders to develop indices that embed our exclusions policy, tilts using the UN Sustainable Development Goals, and a more forward-looking, holistic approach to climate change.

Why alignment matters

The shift from backward-looking emissions data to forward-looking alignment metrics marks an important turning point in responsible investment.

While emissions and green revenues remain essential indicators for how companies are transitioning their business models, they do not reflect future intent. Emissions data can quickly become out of date and may lack comparability, depending on the carbon metric used. It’s why we’re embracing a more nuanced approach – one that prioritises credible alignment with the goals of the Paris Agreement. This is also in line with the Institutional Investors Group on Climate Change (IIGCC)’s Net Zero Investment Framework (NZIF) 2.0.

NZIF 2.0 encourages investors to move beyond simply “reducing financed emissions” and enhance their approach to “financing reduced emissions.” This subtle but important reframing shifts the emphasis from single portfolio decarbonisation while global emissions continue to rise, to real-world change and impact. It aligns with our broader Responsible Investment Framework (PDF, 3MB), which focuses on real world and customer outcomes rather than just outputs.

By embedding alignment metrics into our investment strategies, we aim to build portfolios that are more resilient to climate risks and better positioned to capture the opportunities that the transition to a low carbon global economy brings.

Introducing Robeco’s ‘climate traffic light’ alignment framework

To put this forward-looking approach into practice, we have partnered with Robeco, a global asset manager and recognised industry leader in sustainable investing, to co-create listed equity indices that integrate their proprietary climate traffic light alignment framework.1

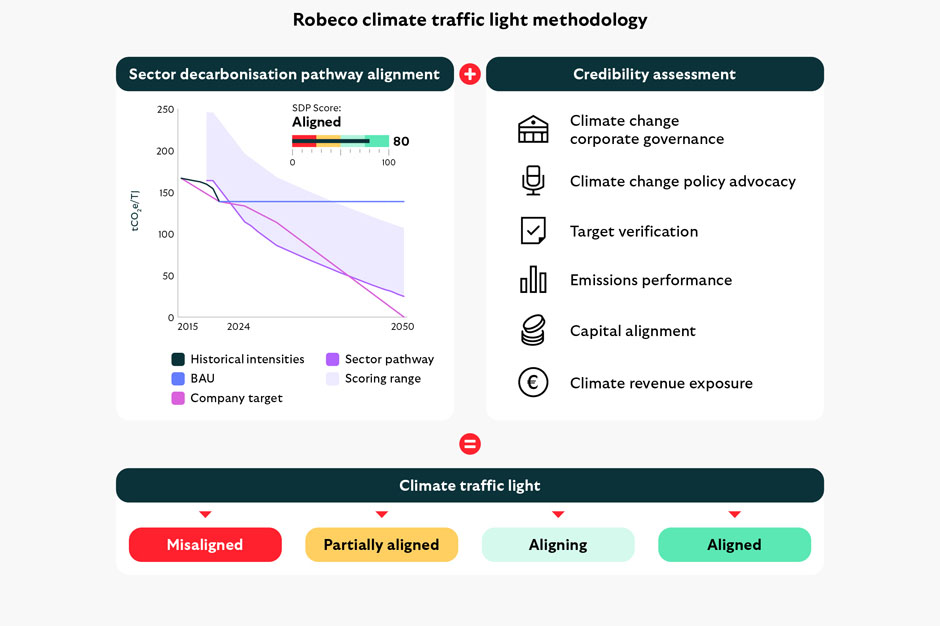

Robeco’s methodology assesses companies based on the alignment of their decarbonisation targets with a below 2°C pathway relevant to their sector2 and the credibility of their decarbonisation strategy. Companies are categorised into four tiers by combining the outcomes of these two separate assessments: ‘Aligned’, ‘Aligning’, Partially aligning’, and ‘Misaligned’ (see Figure 1).

This framework goes beyond emissions intensity or green revenue share, looking also at a company’s targets, governance, capital expenditure, and disclosure practices. This creates a holistic view of whether a company is genuinely transitioning and/or has a clear plan to do so.

Figure 1. Climate traffic light alignment assessment methodology. Source: Robeco

What are the expected outcomes?

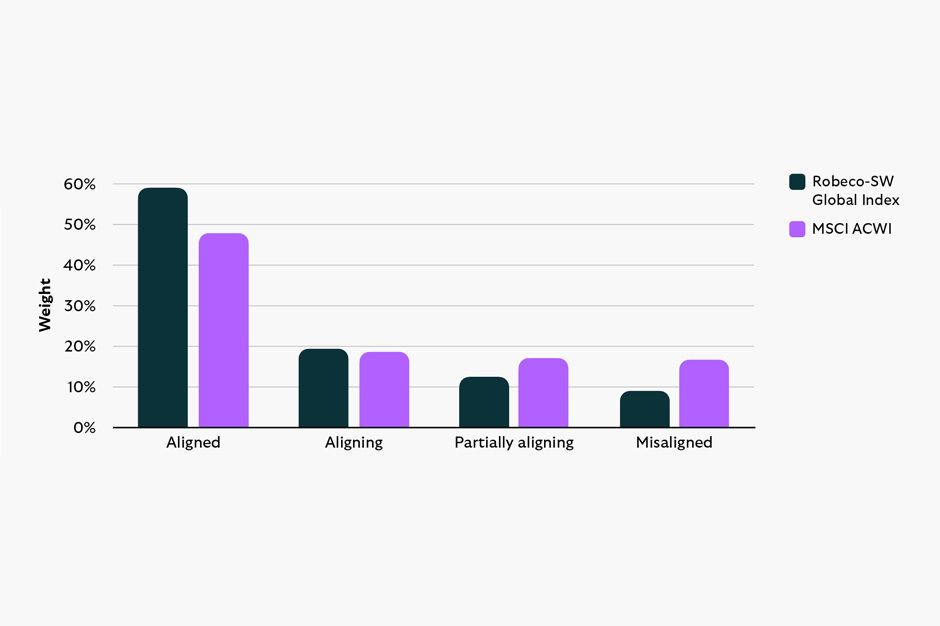

We’ve embedded this traffic light system as one of the building blocks of the custom Robeco-Scottish Widows sustainability-tilted equity indices. The index has been designed to tilt towards companies that are aligned/aligning with the Paris Agreement, while reducing exposure to those that are misaligned (or partially aligning) as shown in Figure 2. These indices are used across our investment proposition, including in our workplace pensions default, Scottish Widows (Lifetime Investment).

An alignment lens also allows for a more nuanced approach to high-emitting sectors. For example, we retain exposure to energy and industrials, although at the time of writing, exposure to both sectors is underweight. Some high-emitting firms in these sectors have credible transition plans with robust capital allocation aligned to net zero.

Conversely, certain technology and consumer discretionary companies – typically seen as ‘clean’ due to low operational emissions – have been flagged as misaligned due to weak governance or lack of credible targets. Our approach allows us to be overweight to the former aligned sectors and underweight to the latter.

These tilts are not just about risk mitigation – they’re about capturing opportunity to deliver good investment outcomes for our customers. We believe companies that are genuinely aligned with the transition are more likely to benefit from regulatory changes, shifting consumer preferences, and technological innovation. ‘Alignment’ is a powerful concept to identify transition opportunities and reduce exposure to potentially ‘stranded assets’. Another expected outcome of alignment tilts is for portfolio emissions (intensity and absolute) to fall over time because we are investing in transition leaders that are driving real world decarbonisation – hence ‘financing reduced emissions’.

Scottish Widows invests in both transition leaders and climate solutions providers. Indeed, we are tilting our overall portfolio towards those companies supporting efforts to mitigate climate change, that deliver both financial returns and help create a better world to retire into for our customers.

Figure 2. Comparison of alignment allocations at end Q1, 2025

Source: Robeco and Scottish Widows

From tilts to stewardship

Alignment data is not just influencing our investment design decisions – it’s also informing our stewardship strategy. We’re using the traffic light system to help determine our corporate engagement priorities and voting activity by highlighting companies that might benefit from a ‘nudge’ to improve their alignment.

We’re also using alignment data to inform our voting decisions. For instance, we may vote against the re-election of directors at companies that remain ‘misaligned’ despite repeated engagement. This sends a clear signal that we expect boards to take climate risk seriously and to embed transition planning into corporate strategy. Moreover, alignment metrics are helping us coordinate across asset classes and mandates. By applying a consistent framework, we can ensure that our stewardship efforts are aligned with our investment strategy – creating a virtuous cycle of influence and accountability.

The integration of alignment metrics into our investment strategy marks a significant evolution in how we approach climate-related opportunity and risk for the benefit of our customers. It reflects our commitment to influencing the transition towards a net zero economy and enhancing our focus from ‘reducing financed emissions’ in our portfolios to ‘financing reduced emissions’ with the intention of contributing towards real-world impact. It's another step in our journey as responsible investors.

References:

- Aberdeen Investments manage the corporate bond indices within Scottish Widows default and also have a methodology for assessing alignment with the Paris Agreement. We are exploring how we could incorporate alignment into fixed income investments, going forward.

- Pathways are intended to be in line with the goals of the Paris Agreement, taking into consideration the “common but differentiated responsibilities” of different nations.

For use by UK employers and advisers only.