How digital innovation is changing pension engagement

Matthew Bailey

Director of EBC Distribution

Pension apps, Tik Tok, gamification, open finance – it’s a brave new world of pension engagement.

It’s a tough nut to crack – getting more people saving enough for their future when around 4 in 10 people are currently on track for less than a minimum lifestyle in retirement*.

It’s a challenge for everyone in the pensions industry and one that the Government has in its sights, too, with its focus on adequacy and raft of pension reforms.

But just how do we get people to engage with their pensions and save more? Even better, how can they take control of their finances today, and connect that up with saving for their future?

Digital engagement is undoubtedly an essential part of the solution to cracking that ‘tough nut’ – but it has to be innovative, effective and flip current engagement strategies on their head.

That was the premise of our recent ‘Digital done differently’ Town Hall session which brought together EBCs and advisers to connect and share ideas.

They also came along to hear more about how Scottish Widows is transforming digital engagement and member outcomes through smart, data-led design which goes far beyond what is available across the pensions industry.

Doing digital differently

Apps are routinely how people manage nearly all aspects of their lives – doing everything from monitoring their fitness to learning a language – and that includes their money and banking.

Pension apps are catching up fast, helping people get a much better idea of what they have, and what they need for their future. But not all apps are the same and the better designed and friction free an app is, the more likely it is that it’ll be used regularly.

With its smart, engineered design, the Scottish Widows app makes naming beneficiaries, pension consolidation, and checking in on funds straightforward, quick, easy and frictionless.

Pension members have embraced the smarter, more intuitive mobile app experience over the traditional desktop. Monthly transactions more than trebled in the year to November 2024, then almost doubled again in the following seven months – this is exponential growth!

Against the backdrop of more than 34 million pension views across all Lloyds Banking Group apps almost every single month, Scottish Widows’ app use is gathering pace. Added functionality such as modelling tools, built-in gamification and personalised nudges are driving uptake and, importantly, helping people to get to know their pensions.

Seeing the whole picture

At Scottish Widows we are all about connecting people with their financial future and the pension app has been designed with in-app open finance (thanks to our partnership with open finance specialists MoneyHub), so that people can see all their finances together in one place if they choose to.

They can understand their savings and their debts in one single view on the app – unlike other providers’ apps which push out to another website, making the user journey harder and leading to inevitable drop-off.

Being able to see pension pots – ahead of pension dashboards which will undoubtedly prove to be a game changer – alongside bank accounts and insurance from a huge number of providers gives people a much better idea of their financial position.

This is about more than just workplace savings; to have the chance of a decent retirement, you need to consider everything you’ve got.

It’s connecting people with their finances in a way which puts them in control so that they know what they’ve got saved, what they need, and can benefit from nudges to improve their overall financial health and wealth now, and in the future.

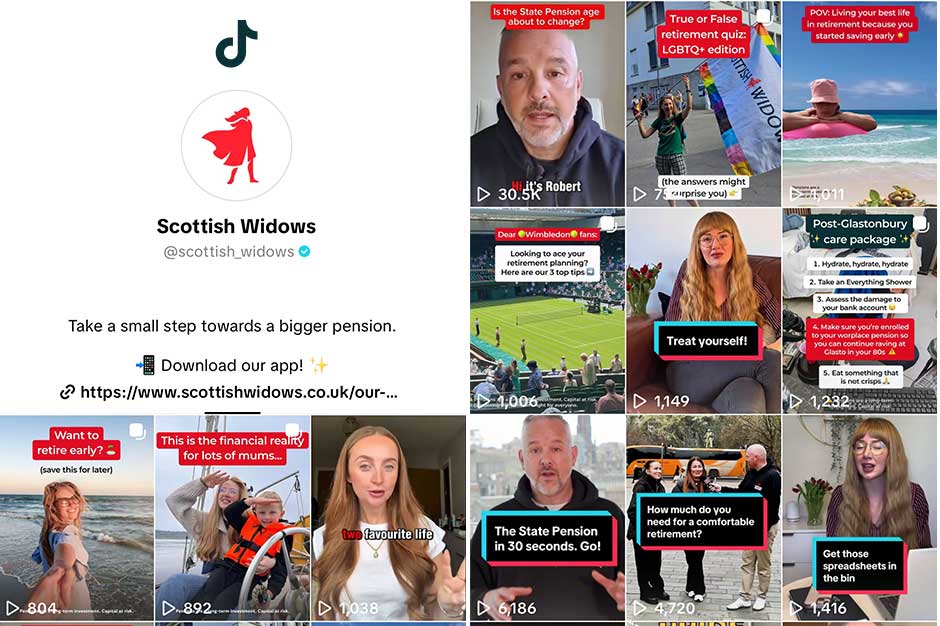

Harnessing Tik Tok for financial education

Driving people to use the app in the first place calls for varied approaches to reach different demographics. Email still works of course, but Tik Tok is one channel we’re using a lot more to reach and engage with all our audiences.

“Think it’s just for the young ones?” our innovation and engagement specialist Robert Cochran asked the audience at the Town Hall. With Tik Tok use at saturation point for the under 30s, and with over 30 million UK users, the biggest growth segments are older as the platform becomes the ‘go to’ for so many, he explained.

He demonstrated how Tik Tok can really engage, with one Scottish Widows’ video getting 24,000 views in the first 24 hours of launch, dwarfing anything we see in other channels. These were purely organic views – when we promote these films the numbers get astronomical with some Pension Engagement films garnering 15 million-plus views.

Where else can you get that messaging out quickly and achieve that level of impact, whether it’s about understanding state pension eligibility or encouraging viewers to think about their pension?

It was a big talking point in the room afterwards, with the realisation that no other pension provider is using TikTok like this, or to such effect. It’s all about taking the message out to where pension members are – making it engaging, as well as useful.

This was our most successful Town Hall yet with the level of audience interaction, follow-up questions, and genuine surprise at the progress we’ve made in the digital space really standing out.

There were lots of questions about where we can take the app, with the backing and the experience of Lloyds Banking Group with its 26 million customers supporting gamification and personalised nudges to help people make good financial decisions.

The brave new world of pension engagement is already here.

The next event for EBCs and scheme advisers is in London on 23 September with Lloyd’s Banking Group Chief Economist, Angus Armstrong.

Sources:

*Scottish Widows Retirement Report 2025 (PDF, 3MB): 39% are on track for a less than minimum lifestyle in retirement.

For use by UK employers and advisers only.