Stress-free pension options

Choose how to put your mind at ease

As you approach retirement, and before you decide how to take your benefits, have a look at what you have, putting more in, what you might get and what your choices are.

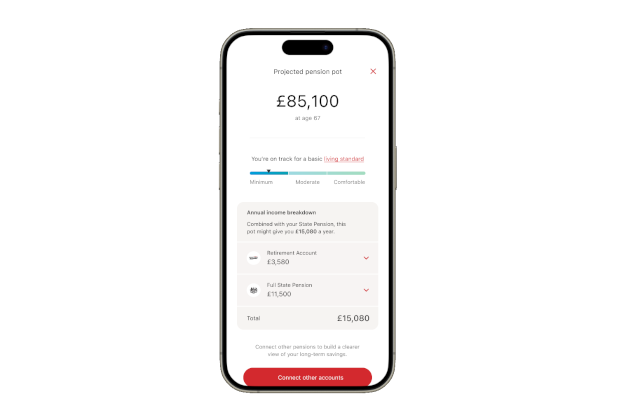

What you might get

See what all your savings could mean to you.

Putting more in

See the potential tax benefits of paying more into your pension.

Your retirement options

Review your options to decide what's right for you.

Stay connected

Keep in contact with your pension using our digital services.

Scottish Widows app

Our app is a simple and secure way to help keep track of your pension.