Pensions Dashboards

What are Pensions Dashboards?

The Pensions Dashboards Programme (PDP) was set up by Money and Pensions Service (MaPS) to enable individuals to access their pensions information, securely, online and all in one place. Working with the Department for Work and Pensions, the Pensions Regulator and the Financial Conduct Authority the objective is to support better retirement planning and improve financial wellbeing.

Increasingly, pension savers in the UK have more than one pension, making it easy to lose track of their pensions and difficult to get a clear picture of what they’re saving for in retirement.

Pensions Policy Institute (PPI) research shows the total value of lost pension pots has grown from £19.4billion in 2018 to £26.6billion in 2022.

Dashboards are intended to provide clear and simple information about an individual’s multiple pension savings plans including their State Pension, in one place. It will also help some savers reconnect with lost pension pots.

How it will work

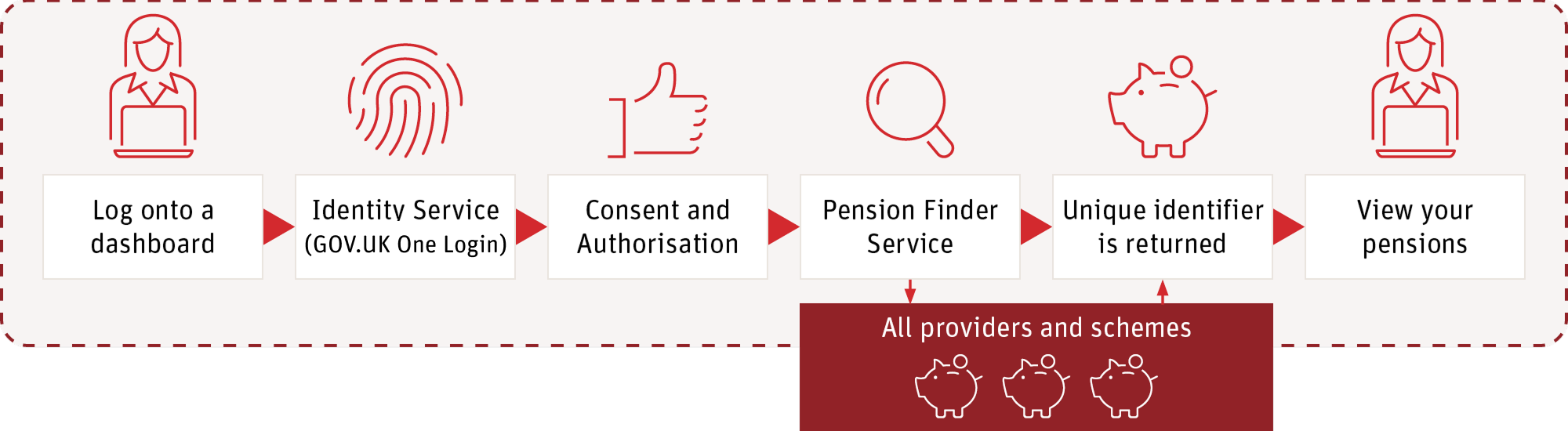

-

It’s a complex project and we’re fully engaged with the PDP, the Association of British Insurers (ABI), the Financial Conduct Authority (FCA) and The Pensions Regulator (TPR). We’ve already connected some pensions and made significant in-roads towards full connectivity. We’re confident in our ability to securely receive and pass savers’ data to the dashboards, in line with the Pensions Dashboards Regulations, FCA rules and Data Standards.

-

A dashboards ecosystem is being developed and tested across the industry which will enable data to be found across schemes and providers and shared with an individual saver. Savers can choose which dashboard they use and could use more than one, or change at a future date.

Explore a series of helpful videos in the Useful Resources section of the Pensions Dashboards Programme website, these explain key concepts, timelines and what trustees need to know.

- A user logs onto a dashboard of their choice and will need to submit forename, surname, address, postcode and date of birth, as well as optional National Insurance number.

- To keep their data safe their request is passed to an identity service to confirm they are who they claim to be.

- They’ll then be asked to consent that their information can be used and to authorise providers to perform a search on the data they hold.

- A pension finder service will then send the request to all pension providers and schemes.

- When a match is made a unique identifier will be returned to the user and reports back all their pensions found (including the State Pension).

- It’ll show names of their pension schemes and estimated values at their selected retirement age.

How pensions will be matched to saversIf their data matches to what a provider holds, administrators will return an identifier that shows a full match and will provide the pensions information once the saver makes a ‘view request’.

If some of their data matches, then a 'partial match' will be returned along with the administrators' contact details. The saver will need to contact them to go through a verification process to identify whether the pension is theirs to be able to add that pension to their dashboard in future. These contact details will be on their dashboard for 30 days after which time they will be withdrawn.

In some circumstances we'll be unable to match the data a saver submits so nothing will be returned.

It’s important to know the pension finder isn’t a database. It doesn’t hold any personal or pensions data but acts more like a switchboard. Once a saver consents to finding their pensions, the technology fetches and delivers relevant information directly to their own personal dashboard.

We’re working with our customer service colleagues to make sure they’re ready to help savers who contact us after receiving a ‘partial match’ and those who re-engage with us after finding a policy through a dashboard.

-

Find Data

‘Find Data’ consists of the personal data provided by the saver to the dashboard and sent by the dashboard's pension finder service to providers, to enable them to search their records for a match.

Some ‘Find Data’ elements will be verified by the dashboard identity service (including first name, last name, date of birth and current address) and some will be self-asserted by the saver (including National Insurance number, previous last name, previous address, email address, mobile number).

Where a provider makes a full match, they will register a unique identifier and savers will have access to the ‘View Data’. Where there is only a ‘partial match’ the provider will send a message with a unique identifier and scheme contact details so the saver can contact the provider to verify if that pension is theirs, and if it is, the provider will update their records.

View Data‘View Data’ is returned to the dashboard by pension schemes or providers where they have made a match, and is the collective term to describe the administrative data, additional signpost data, value data, and contextual data savers will be shown on their dashboard.

Administrative data - scheme name, dates of membership, name and contact details of administrator, employer name.

Additional signpost data - hyperlinks to websites (e.g. the scheme’s website) where an individual can find useful information about the scheme (e.g. costs and charges etc).

Value data - current fund value, how much pension has been built up to Selected Retirement Age (SRA) if premiums cease, and how much pension will be built up to SRA if premiums continue. We’ll also use the new Actuarial Standard Technical Memorandum 1 (AS TM1) value basis for those calculations, where required, from 1 October 2023. This includes Contextual Information on the value data e.g. illustration date, or type of benefit.

Once a saver consents to finding their pensions, the technology fetches and delivers relevant information directly to their own personal dashboard.

If a scheme is a Group Personal Pension, Group SIPP or Group Stakeholder with Scottish Widows, as provider we’ll provide the connectivity and data to dashboards ecosystem for these schemes.

For detailed information on Data Standards visit https://www.pensionsdashboardsprogramme.org.uk/standards/data-standards

-

Trustees are responsible for ensuring their schemes comply with the Pensions Dashboards Regulations 2022, including connecting to the dashboards ecosystem. We’re here to support and guide trustees through this process using Scottish Widows Connectivity (PDF, 100KB).

A helpful checklist is available on The Pensions Regulator’s website.

If your scheme is part of the Scottish Widows Master Trust, Mercer Master Trust, or an own trust occupational pension scheme, trustees are responsible for connecting the scheme (based on its connectivity date) and supplying data to dashboards.

As a provider, Scottish Widows will work in partnership with trustees or scheme managers to deliver a connectivity solution that meets their regulatory requirements and supports a smooth onboarding experience.

What you can do at the moment

We recommend reviewing the The Pension Regulator guidance for trustees.

This includes practical steps to help you get ready for connection, such as:

Reviewing the quality and completeness of your scheme’s member data. Accurate data—especially names, postcodes, dates of birth, National Insurance numbers—will help ensure members can be matched successfully and receive their pension information via dashboards.

Ensuring your scheme’s signpost information is up to date. This includes documents such as your Costs and Charges Statement, Implementation Statement, and Statement of Investment Principles (where applicable), which must be made available to dashboard users.

Considering whether to use Scottish Widows Connectivity for your scheme. If so, you’ll need to agree to our standard match criteria (PDF, 200KB) and sign a supplemental service agreement covering dashboard services, data sharing, and privacy requirements.

Reviewing your scheme’s Data Protection Notice (DPN) to ensure it reflects data sharing within the dashboards ecosystem and with relevant government bodies.

You can also visit the Pensions Dashboards Programme for the latest updates, technical standards, and resources.

If you have a Relationship Manager, you can also discuss this with them.

If your scheme is an Own Trust Occupational Scheme or a Group AVC scheme with Scottish Widows or Clerical Medical you can:

- View an example Servicing and Data Sharing Agreement (PDF, 300KB)

- Contact us at pensionsdashboard@enquiry.scottishwidows.co.uk if you want to arrange for your Scottish Widows or Clerical Medical scheme to get connected to Pensions Dashboards using one of our Scottish Widows Connectivity options or if you want to follow up on an existing connectivity instruction that you’ve given us.

- Request a copy of your scheme’s member data and tell us about any updates required, by contacting us by email: Scottish Widows corporatelsc@lscservices.scottishwidows.co.uk or Clerical Medical eservices.support@lscservicesscottishwidows.co.uk

- Review our Data Privacy Impact Assessment. A copy is available on request from pensionsdashboard@enquiry.scottishwidows.co.uk

-

Once we receive your scheme’s connectivity instruction, we’ll begin working directly with your trustees or third-party administrator to gather the necessary information to support your connection to the pensions dashboards ecosystem. This includes issuing a contractual data processing and services legal agreement, which must be completed and returned.

We’ll also request additional key details such as your scheme’s TPR registration code and other data required to enable a successful connection.

To ensure we can connect your scheme on time, we need all required information and signed agreements at least four weeks before your scheme’s connect-by date. If we don’t receive everything in time, we may not be able to complete the connection by your scheme’s deadline.

If you choose Scottish Widows Connectivity we can help you with your Regulatory Reporting requirements.

News and historic updates

-

Scottish Widows remains a committed supporter of the dashboards initiative. We believe dashboards will transform how savers engage with their pensions and plan for retirement.

We have successfully connected over 5 million pension members to the dashboards ecosystem, and we’re continuing to grow that number as more schemes come on board and reach their staging dates.

We have partnered with Equisoft as our integrated service provider to support our Pensions Dashboards connectivity. Equisoft is a recognised leader in the pensions technology space, known for delivering robust, scalable solutions across the industry. Their expertise helps ensure a smooth and compliant connection journey for schemes using Scottish Widows Connectivity.

We are actively supporting schemes with their preparations for connection.

We are offering a choice of connectivity solutions, including both multiple source (for AVC schemes) and single source.

We are engaging with trustees ahead of their scheme’s connection date to share required documentation, including a Data Processing Agreement.

We are regularly reviewing our guidance materials, to reflect the latest regulatory and operational developments.

-

The Pensions Dashboards Programme (PDP), led by the Money and Pensions Service (MaPS), continues to progress towards full industry connectivity. The Department for Work and Pensions (DWP) has confirmed that all in-scope pension schemes must connect to the dashboards ecosystem by 31 October 2026, with a staged timetable for connection starting from April 2025.

You can view the full guidance and timetable on the Pensions Dashboards Programme website and the Pensions Regulator’s checklist.

-

The third “connect by” deadline passed on 30 June 2025, with several providers and administrators confirming successful connections.

PDP has published an updated Data Protection Impact Assessment (DPIA) for the central digital architecture and refreshed its guidance to support trustees and providers with connection planning. This DPIA does not cover the MoneyHelper dashboard (MaPS’ own consumer-facing dashboard), which will be addressed in a separate DPIA.

As part of the Money and Pensions Service (MaPS), the Pensions Dashboards Programme (PDP) is working closely with the team developing the government-provided MoneyHelper pensions dashboard. Consumer testing is expected to begin in summer 2025, starting with moderated sessions to evaluate the user experience and inform future design and functionality.

The Pensions Regulator (TPR) has refreshed its guidance to reflect MaPS updates and provide clarity on connection scenarios, complaints, and registration codes.

You can find the latest news and guidance on the Pensions Dashboards Programme website.

-

Scottish Widows continue to be keen supporters of pension dashboards. We believe dashboards will create a significant shift in the pensions industry to help savers engage more readily with their pensions and feel more confident about planning for a retirement they want.

We are delighted that the programme has published connection dates and are continuing to work closely with the Pension Dashboard Programme, and key government bodies, as we make significant progress towards connectivity.

We have recently joined the Pension Dashboard Operators Coalition who will collectively work with government and regulators to help support the successful launch of dashboards for consumers. We are in the ‘Connected 20s’, the decade when tech finally comes into its own to help people manage their day-to-day lives, including their money, savings and pensions.

Becoming an FCA regulated qualifying pensions dashboard services (QPDS) operator is a natural next step for Scottish Widows, giving customers more control and helping them find their lost pensions.

-

On 25 March 2024, the Department for Work and Pensions (DWP) issued a written ministerial statement announcing the publication of the timeline for connecting to pensions dashboards set out in guidance.

This follows the Pensions Dashboards (Amendment) Regulations 2023 for all occupational pension schemes in scope, and the Financial Conduct Authority rules covering personal and stakeholder pensions, which provided a deadline of 31 October 2026 to have completed connection.

DWP’s guidance sets out the staged timetable for when pension providers and schemes in scope of legislation are expected to connect to the dashboards ecosystem. Connection for industry will start in April 2025.

While the connection dates are not statutory, pension providers and schemes must have regard to this guidance. Trustees or managers and pension scheme providers will need to be able to demonstrate, upon request, how they have had regard to this guidance.

The Staging Timetable is set out as follows:

Part 1: Large Schemes and Providers - Largest schemes to connect by 30 April 2025

Part 2: Medium Schemes and Providers - First connections to be made by 31st January 2026

This will then continue in monthly increments as size decreases until 30 September 2026.

This then leaves a one month buffer until the legal connection deadline of 31 October 2026.

See government guidance for details on what is meant by a ‘large’ and ‘medium’ scheme in this context.

For employer and trustee use only.