Welcome to your Workplace Pension

Trustee Buyout Plan

Important things to do

Planning for your future

Beware of scams

Watch our film to find out how to spot a pension scam.

Film running time 1.5 mins.

Supporting vulnerable customers

This film explains the additional support services available to you through our partnerships. You can also learn more about these in our support guide (PDF, 1MB).

Film running time 2 mins.

Tools & calculators

-

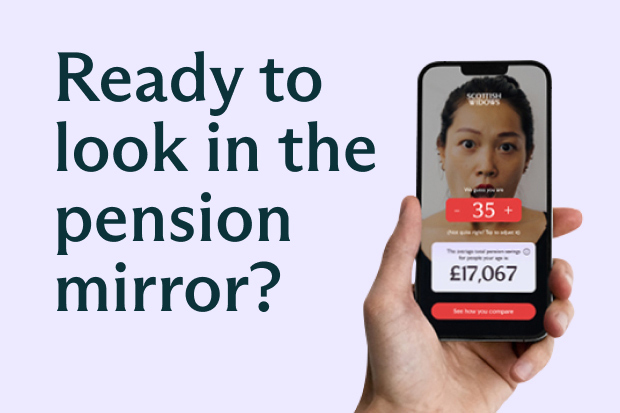

First we’ll guess your age. Then we'll show you what people the same age have saved in their pension. Having something to compare yourself to is a great first step in checking whether your pension is on track.

-

Use the calculator Opens third party site in a new tab

Use the calculator Opens third party site in a new tabOur retirement calculator can help you find out what your income and lifestyle could be in retirement.

Having the value of any pensions, savings and investments you have will help you get the most out of the calculator.

Library & resources

-

Below you will find information about your investment options and charges. Unless you have selected your own investments, your employer will have selected a default investment option when you joined the scheme. This will be detailed in the welcome pack that was sent to you in the post when you joined the scheme. You can also review where your savings are invested, and make changes, through our app or by logging in to your secure portal.

Investment choices and charges Explore information on the alternative investment options available to you, past performance, their charges and their fund factsheets.

Charges sheet (PDF, 300KB)

This lists the pension fund choices that are available to you and the total annual fund charge for each fund.

Pension Investment Approaches guide (PDF, 900KB)

Our Pension Investment Approaches (PIAs) are our fully governed range of investment strategies. In this detailed guide you’ll find details of the different options available to you.

Fund guide (PDF, 1MB)

This guide provides information on the different fund choices that are available to you.

We may have provided links to documents and other information supplied by third parties (which may include your employer or their advisers). They are solely responsible for their content and accuracy. All statements, views and opinions contained in these documents and other information are those of the third parties, not Scottish Widows.

-

Key Features and Terms & Conditions library and resources Key features of your plan (PDF, 1MB)

This detailed guide contains important information about your plan and how it works.

Terms and conditions (PDF, 400KB)

This contains details of the terms and conditions of the plan.

We may have provided links to documents and other information supplied by third parties (which may include your employer or their advisers). They are solely responsible for their content and accuracy. All statements, views and opinions contained in these documents and other information are those of the third parties, not Scottish Widows.

-

Useful information library and resources Nomination form (PDF, 500KB)

Please let us know who you wish your pension benefits to go to upon your death. You can nominate your beneficiaries through the Scottish Widows app and your online services. If you’d like to use this form instead, please complete this form and send it back to us.

We may have provided links to documents and other information supplied by third parties (which may include your employer or their advisers). They are solely responsible for their content and accuracy. All statements, views and opinions contained in these documents and other information are those of the third parties, not Scottish Widows.

Contact us

-

When you speak to us, we’ll ask you for your plan number. This helps us to make sure you’re speaking to the right team. If you don’t have your plan number, we can still help you.

We will then ask you some security questions, so we can check who you are.

We want you to get the best service, so we may record your call for training purposes.

-